3 Benefits of Getting a Pre-Approval

Anyone interested in buying a house can get a pre-approval from a lender or broker who performs a check of their credit history, verifies their income, and then provides an assurance that they would be able to get a loan up to a certain amount.

Should I Buy a Home in Cash or With a Mortgage?

If you have the money to buy your dream home, then you might assume paying in cash is the way to go. This could be true, but the choice between paying in cash and getting a mortgage isn’t black and white.

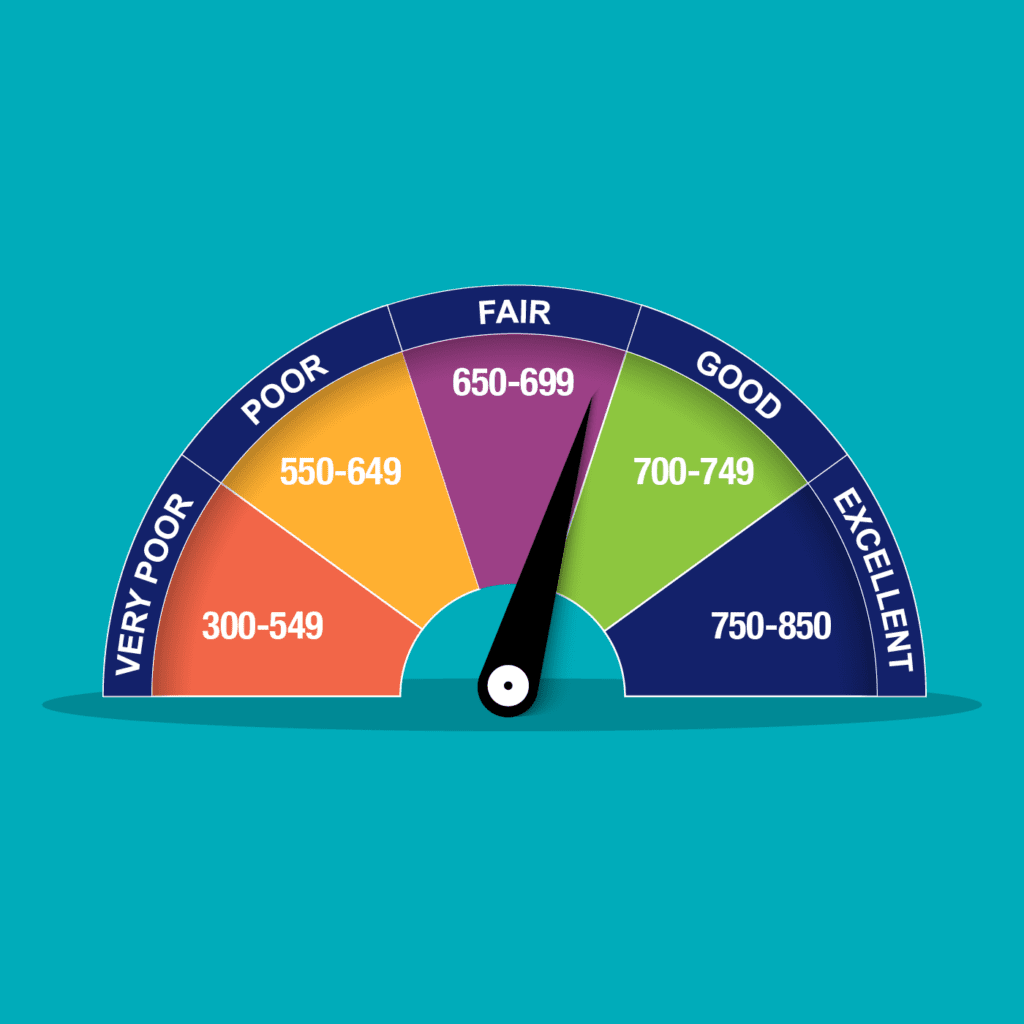

Get Financing With a Low Credit Score

Low Credit Scores Can Still Get Loans Do you have a low credit score because of financial problems you have had in the past? Perhaps you went through a bad divorce or you owned a small business that went bankrupt or a consumer proposal. You might have lost your job and defaulted on your loans […]

5 Mistakes to Avoid Getting Rejected for a Mortgage

You can reduce the chance of rejection by avoiding these mistakes that have a virtually immediate negative impact on your credit score.

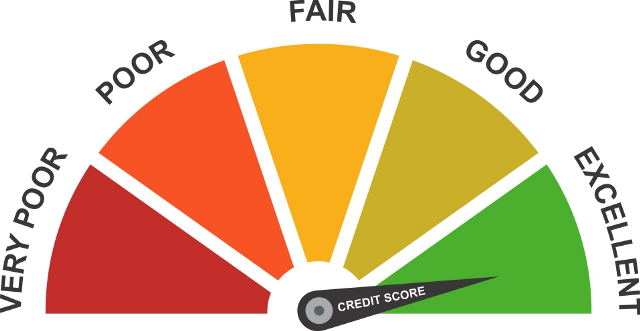

3 Easy Ways to Improve Your Credit Score.

Want to know how to improve your credit score? Boost your credit with these 3 easy tricks.