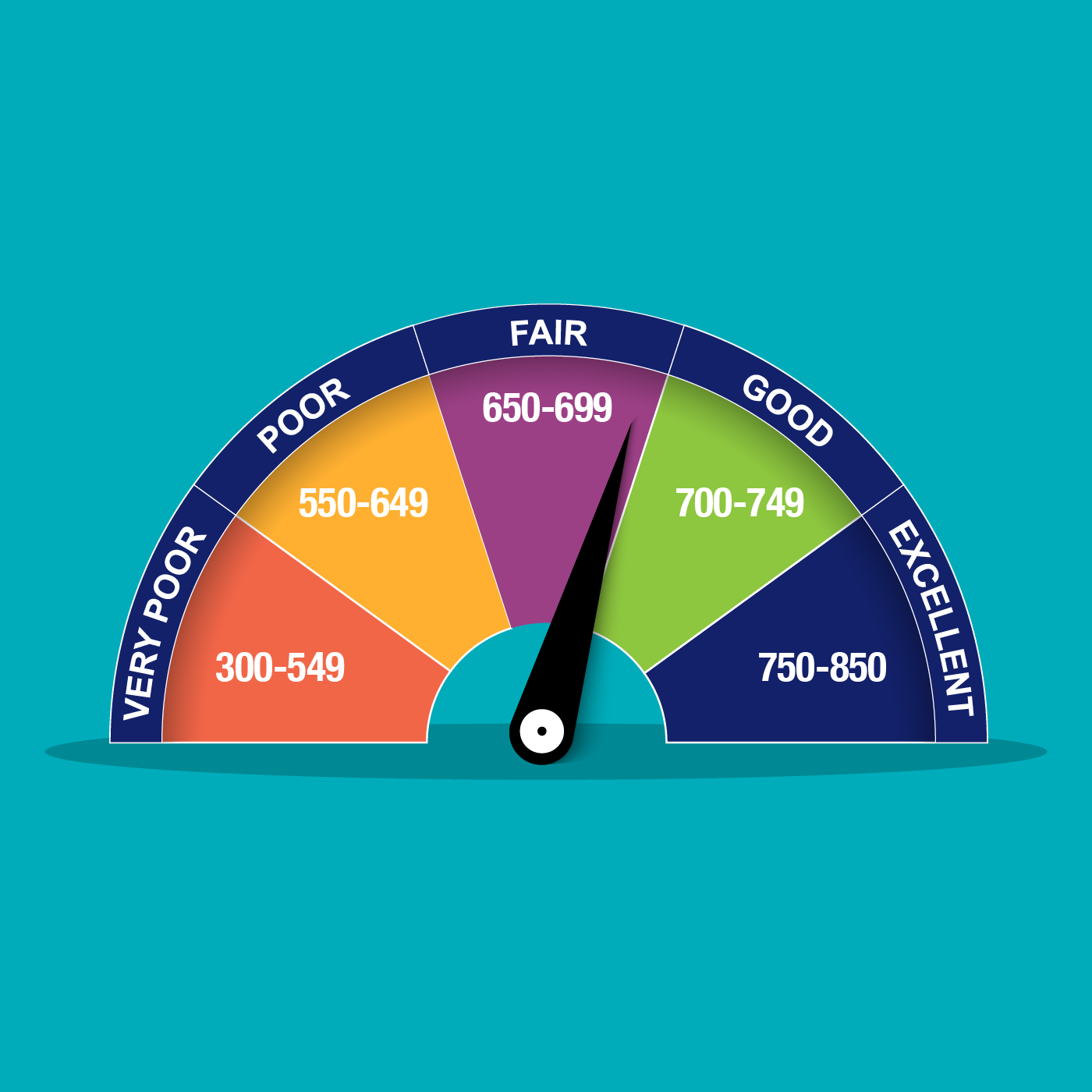

Want to know how to improve your credit score? Most credit scores, including FICO scores, operate within the range of 300 to 850. The credit tiers generally look like this:

Excellent: 750 – 799

Good: 700-749

Fair: 650 – 699

Poor : 550 – 599

Terrible : 500 – 549

Oh no: 499 and below

1. Pay your bills on time

Maybe this should go without saying. But delinquent payments, even if only a few days late, and collections can have a major negative impact on your FICO Scores. If you have missed payments, get current and stay current. The longer you pay your bills on time after being late, the more your FICO Scores should increase. Older credit problems count for less, so poor credit performance won’t haunt you forever.

Setting up an online bill-paying system that can pay your minimum balance due, or ideally the whole balance if you can manage that. Otherwise have a system of where you open your mail, where you put your bills, and when you pay them.

Late Payments and Collection Accounts

Be aware that late payments and paying off a collection account will not remove it from your credit report. It will stay on your report for seven years. If you can’t make your payments on time contact your creditors or see a legitimate credit counselor. This won’t rebuild your credit score immediately, but if you can begin to manage your credit and pay on time, your score should increase over time.

2. Manage your Credit Balances

Keep balances low on credit cards and other “revolving credit”. High outstanding debt can affect a credit score.

Pay off debt rather than moving it around.

The most effective way to improve your credit scores in this area is by paying down your revolving (credit card) debt. In fact, owing the same amount but having fewer open accounts may lower your scores.

- Don’t close unused credit cards as a short-term strategy to raise your scores.

- Don’t open a number of new credit cards that you don’t need, just to increase your available credit. This approach could backfire and actually lower your credit scores.

3. Make Sure Your Credit Report is Accurate to improve your credit score

Everyone has three credit reports, one from each of the 3 major credit bureaus: Experian, Equifax, and TransUnion. Since your credit scores are based on the data in your credit reports if you have a mistake on your credit report, your credit score will reflect that mistake.

You’re entitled to a free copy, once a year, of all three of your credit reports under the Fair Credit Reporting Act. These reports can be accessed via AnnualCreditReport.com, the government-mandated site run by the major bureaus.

Once you have your credit reports in hand, here’s a quick checklist of questions to ask yourself to help you spot potential errors:

- Is all of your personal information accurate?

- Are your credit accounts being reported?

- Late or missed payments listed that you remember making on time?

- Accounts or applications for credit you don’t recognize?

- Are items from decades ago still appearing on your report?

If you are considering Refinancing or Purchasing a home, then let’s start off with a quick inquiry that does not require you to share any sensitive information.