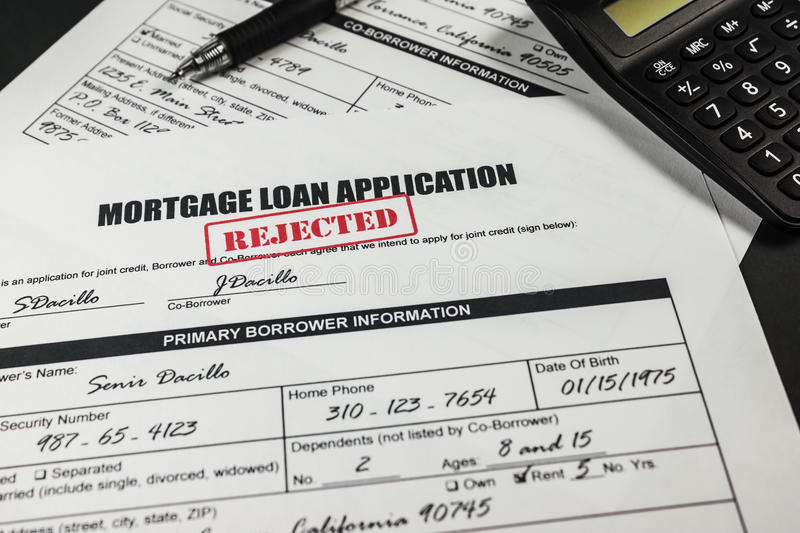

Amassing a big pile of cash for a down payment–to apply for a mortgage is a daunting task. Oftentimes first-time buyers pause as they grasp the meaning of the phrase, “mortgaging your future.” And understandably so, nobody wants a rejection for a mortgage after they apply for one.

If you get over that hurdle, you are on your way to the 7/8 applications that get approved. A pessimist might observe that means the application has a one-in-eight chance (12.5%) of being rejected. Yet, if you are proactive, you can avoid the following mistakes that virtually immediately negatively impact your credit score.

The experts at Realtor.com have come up with a list of five mistakes you can easily avoid to make sure that your application is approved and not rejected.

1. Use your credit cards

One way to establish creditworthiness is to use the credit you have. That doesn’t mean to pile it on, but use the cards you have and pay them on time to build up a credit history. If you really don’t want to do that, some lenders will look at your history of rent payments and other regular bills that you have.

2. Don’t open new credit cards near the time you are applying for a mortgage

According to Realtor.com, opening a new credit card account can cost you up to five points on your credit score. That may be enough to disqualify you for a mortgage. Also, don’t spend a lot of cash (or use credit on existing cards) before you get the mortgage and move in.

3. Don’t miss a payment on a medical bill

If you run up some big medical bills, work with a doctor or hospital to develop a payment plan you can live with. If you default on a medical bill, it typically results in the provider referring your account to a collection agency and the agency referring your status to the credit reporting agencies.

4. Don’t change jobs

Most mortgage lenders want to see at least two years of consistent income before approving a loan. There are exceptions, of course, but sticking with the job you have until the mortgage is approved is a better choice if at all possible.

5. Don’t lie on the mortgage application

This should be obvious. In the first place, if you stretch the truth it is mortgage fraud, a federal crime. Second, mortgage lenders do their homework, and chances are they will find out, and there goes the mortgage. While it might seem quaint these days, honesty is the best policy when it comes to getting a mortgage.

By Paul Ausick 24/7 Wall Street