Get Financing With a Low Credit Score

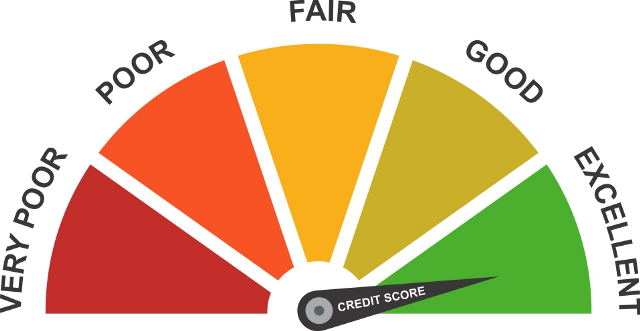

Low Credit Scores Can Still Get Loans Do you have a low credit score because of financial problems you have had in the past? Perhaps you went through a bad divorce or you owned a small business that went bankrupt or a consumer proposal. You might have lost your job and defaulted on your loans […]